Why Red Swan?

Tune RiskMetrics for Peak Performance.

Red Swan was founded with a simple purpose: To deliver the best risk solution possible using the best analytics platform. Driven by the commitment to optimize RiskMetrics for speed and flexibility while reducing model risk errors, Red Swan delivers a fully integrated risk solution that is easier and less expensive to implement and maintain without sacrificing performance.

Power, Speed and Precision.

Starting with the most powerful and comprehensive risk analytics engine from RiskMetrics, Red Swan takes it to another level by applying the same rigorous methodology to the entire risk process. Using optimized model configurations in the most dynamic and efficient manner, Red Swan consistently delivers the most reliable risk results to the end user as swiftly as possible.

The Preeminent RiskMetrics Integration Solution

Red Swan delivers higher performance, stability, and reliability at a fraction of the cost of custom development and maintenance expenses, all backed by Red Swan’s industry-leading support and consultants. Even the most complex implementations are easy to handle with Red Swan’s fully integrated software solutions.

Adding new risk models?

Simple – they are included

Migrating to web services?

Red Swan does it faster than the you can imagine. It’s built in.

Need to turbocharge your risk by aggregating simulated returns?

The Red Swan upgrade is all you need.

Peak performance requires

better model risk management.

Manage model risk better,

with Red Swan Risk.

- block_title: 1

- background_color: #f9f9f9

- color: 344659

- content_alignment: left

- text_align: left

- text_size:

- block_padding_padding_top:

- block_padding_padding_bottom: 50

- block_padding_padding_right: 25

- block_padding_padding_left: 25

- block_padding:

- include_button: 1

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

- link_domain: 1

- button: 9

- page_target: _self

- button_label: Contact Red Swan Risk

- video_block_on: 0

- video:

- header_color:

- custom_class:

- colors_background_color:

- colors_color: FFFFFF

- colors_header_color:

- colors:

- text_text_align: default

- text_text_size:

- text:

- button_link_domain: 1

- button_button:

- button_page_target: _self

- button_button_label:

- block_height_group_block_height:

- block_height_group_auto_block_height:

- block_height_group:

- overlay_color:

What is Model Risk?

Model Risk

Intrinsic Model Risk is a challenge with every risk system. The more complex the model, the higher the potential model risk.

Extrinsic Model Risk, caused by input data errors and model configuration mistakes, can compound model risk significantly and cause severe distortions to risk optics.

Model Risk Mitigation

Red Swan's consulting experts deploy our software solutions to configure risk models and processes for optimal performance.

By minimizing Extrinsic Model Risk, Red Swan improves the veracity and confidence of risk reporting.

Ongoing Challenge of Model Risk Management

Maintaining optimal performance requires constant vigilance and responsiveness to prevent excessive model risk from creeping back into reports.

Red Swan services provide ongoing maintenance, monitoring, diagnostics, and timely mitigation required to manage model risk effectively.

Model Risk

Model Complexity

Extrinsic Model Risk

Extrinsic Risk is model risk that can be controlled. With careful analysis and proprietary software, Red Swan experts mitigate model risk and monitor against its return.

Intrinsic Model Risk

Intrinsic Risk is model risk inherent in any risk system. Properly configured models should be as close to this level of model risk as possible. Red Swan makes it easier to accomplish.

Equity

Sovereign Debt

CMO/CLO/CDO

- block_title: 0

- background_color:

- color: FFFFFF

- content_alignment: center

- text_align: default

- text_size:

- block_padding_padding_top:

- block_padding_padding_bottom:

- block_padding_padding_right:

- block_padding_padding_left:

- block_padding:

- include_button: 0

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

- video_block_on: 0

- video:

- header_color: headers-light

The Hidden Danger Of Model Risk

Risk management is an inherently unstable process due to continuous changes and growing complexity.

Portfolio holdings, models, market data, technology, reporting requirements, and risk personnel regularly change through the course of business. This creates an ongoing maintenance challenge to keep the risk processes up-to-date and performing optimally.

Without proper attention, modeling errors and mistakes can compound, distorting optics to the point where risk output is no longer trusted by risk and portfolio managers, investors, or regulators.

This type of Model Risk catches many firms by surprise because they are not aware how severe it can be until it is a very serious and costly problem.

- block_title: 1

- background_color:

- color: 344659

- content_alignment: center

- text_align: left

- text_size:

- block_padding_padding_top: 50

- block_padding_padding_bottom: 50

- block_padding_padding_right: 25

- block_padding_padding_left: 25

- block_padding:

- include_button: 0

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

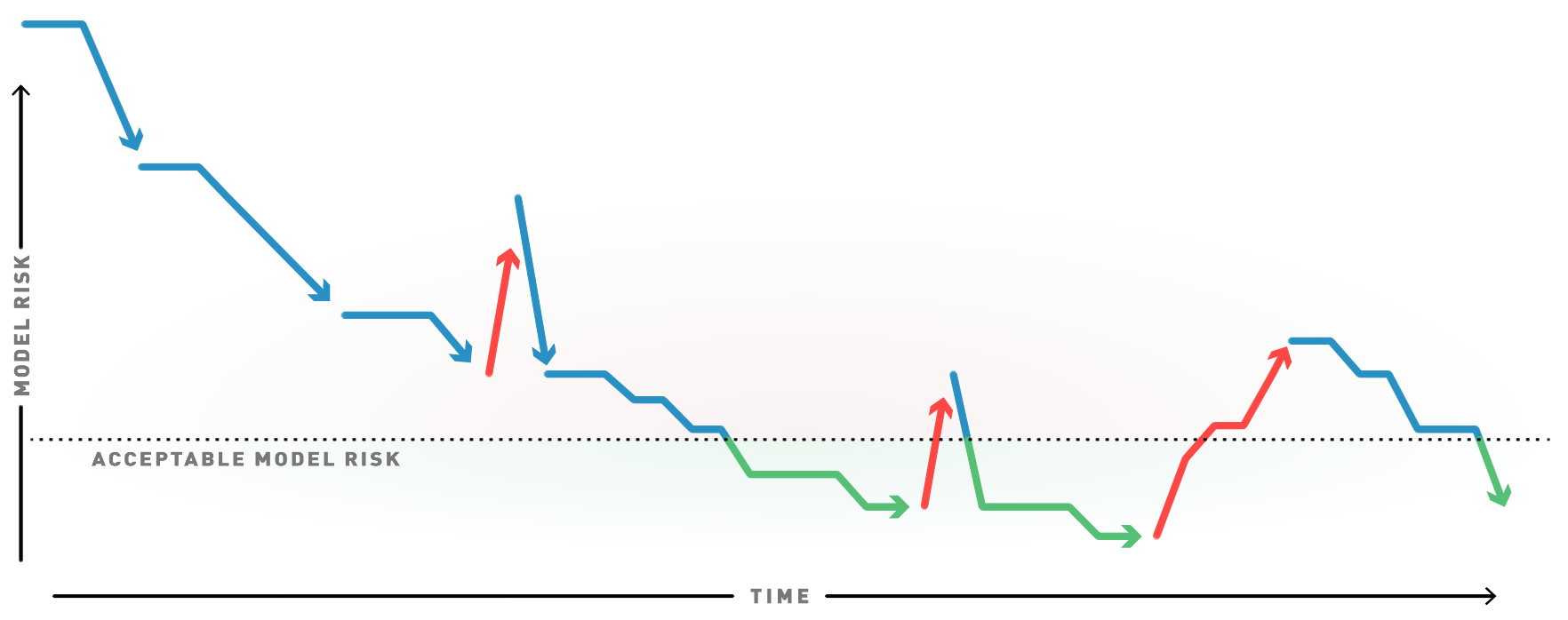

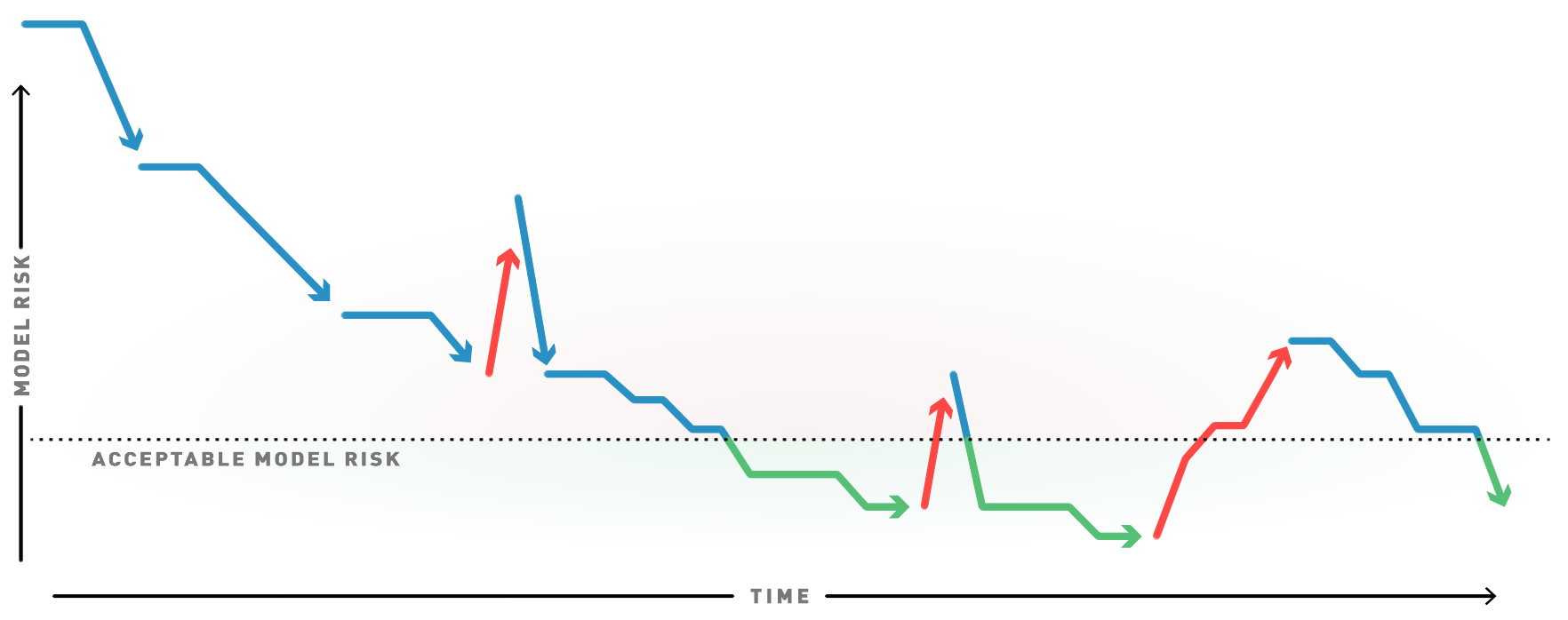

Example Timeline of Model Risk Errors and Corrections

Risk report accuracy declines regularly in the course of business: Input/output data errors, model configuration, formatting, & validation errors all contribute to the degradation of risk reporting trustworthiness.

Red Swan Risk has been diagnosing and remediating Model Risk since 2008, directly targeting the sources of Model Risk.

- Input/output data management and process automation

- Model configuration, formatting, and validation

- Ongoing monitoring, diagnostics, analysis and remediation

- Version control, documentation and audit support

Market data error distorts reports

Increased sizing of option position exposes model error

New security types added to portfolio

Exchange-�traded positions added using fast-fill model

Proxy rules �added for positions that cannot be modeled

Exchange-�traded mapping rules adjusted

Fully modeled positons added

Market data over-rides to fully modeled positions

New models re-configured to new market data

- block_title: 1

- background_color: #f9f9f9

- color: 344659

- content_alignment: center

- text_align: left

- text_size:

- block_padding_padding_top: 50

- block_padding_padding_bottom: 50

- block_padding_padding_right: 25

- block_padding_padding_left: 25

- block_padding:

- include_button: 0

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

- header_color:

- custom_class: timeline

Proven Solutions for the Most Common RiskMetrics® User Needs

Choose your RiskMetrics® Challenge

Web Services Automation

Creating and Managing Unitized Holdings

RML Generation

Model Risk Management

Repository for RiskManager/RiskServer output

Integration of historical risk statistics, simulated returns, risk factors, realized PnL & other relevant information (custom tags/hierarchies)

Aggregation tool for both additive and non-additive risk data (simulated returns)

Portfolio Construction

What-if-capability for Easy way to connect to data and create custom dashboards/visualizations using common BI tools

Advanced data analysis and interrogation such as risk monitoring and error remediation

All RiskManager Challenges and Solutions

RiskMetrics® Challenges

Proven Red Swan Solution

Web Services Automation

Utility for automating web service calls to RiskServer.

Learn More

Creating and Managing Unitized Holdings

Tool for converting complete portfolio details into a unitized set of securities for consumption by RiskManager/RiskServer.

Learn More

RML Generation

Automatically translates mapping rules into well-formed RML 3 or 4 files.

Learn More

Model Risk Management

User friendly tool for defining, building and documenting mapping rules that assign securities to the proper RiskMetrics model.

Learn More

Repository for RiskManager/RiskServer output

Automatically extract and load risk statistics, simulated returns and log files into historical database.

Learn More

Integration of historical risk statistics, simulated returns, risk factors, realized PnL & other relevant information (custom tags/hierarchies)

Custom data schema that combines risk, PnL, market data and book structure to support comprehensive analysis.

Learn More

Aggregation tool for both additive and non-additive risk data (simulated returns)

Computes any statistic at any hierarchy, including VaR computed from position level simulated returns, re-weighted to actual portfolio holdings.

Learn More

Portfolio Construction

Enables on-the-fly aggregation for portfolio construction without having to re-run portfolio in RiskManager.

Learn More

What-if-capability for Easy way to connect to data and create custom dashboards/visualizations using common BI tools

Enables near instance calls to any statistic or PnL at any hierarchy from the cube to be viewed in Excel or any BI tools that supports OData.

Learn More

Advanced data analysis and interrogation such as risk monitoring and error remediation

Supports Cube and DB calls via RS API for custom analysis and KPI style tests.

Learn More

- custom_class: proven-solutions

- block_title: 1

- background_color: #f3f3f3

- overlay_color:

- color: 344659

- header_color: headers-dark

- text_align: left

- text_size:

- content_alignment: center

- block_padding_padding_top: 50

- block_padding_padding_bottom: 50

- block_padding_padding_right: 10

- block_padding_padding_left: 10

- block_padding:

- include_button: 0

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

Rating – Value – Software

Value

Red Swan clients rate our software an average of 4.7/5 stars for value

- block_title: 0

- background_color: #f9f9f9

- color: 344659

- header_color:

- content_alignment: center

- text_align: default

- text_size:

- block_padding_padding_top:

- block_padding_padding_bottom:

- block_padding_padding_right:

- block_padding_padding_left:

- block_padding:

- include_button: 1

- link_domain: 1

- button: 964

- page_target: _self

- button_label: Full Survey Results

- block_height:

- auto_block_height: a:1:{i:0;s:4:"auto";}

- custom_class: rating