A simple, easy and reliable method for adding, modifying, or changing risk models.

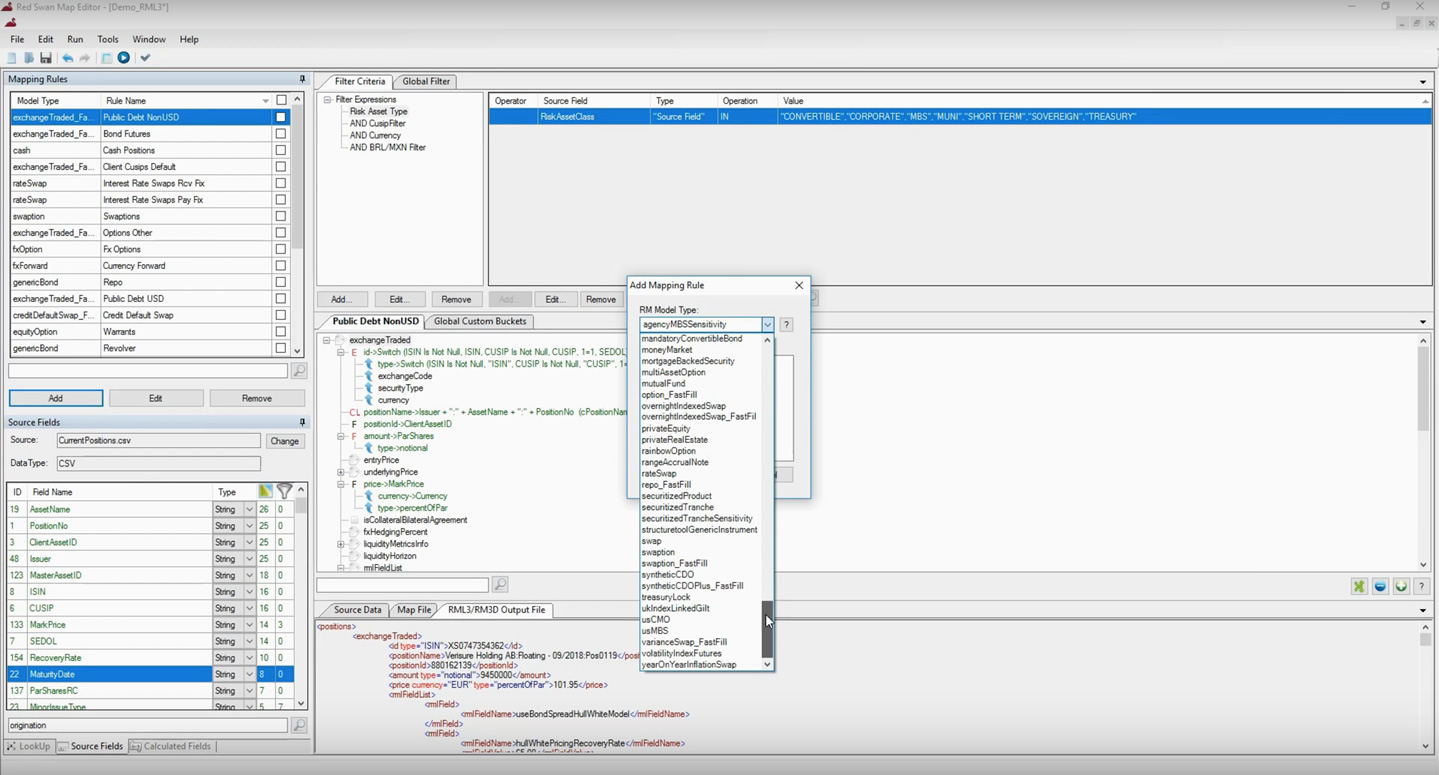

- New security types in portfolio may require a new RiskMetrics model

- Fine-tuning of model configurations (i.e. market data overrides)

- Desire to take advantage of new RM model releases type to better model your portfolio

- Example: replace generic bond model with bank loan model

Challenges

- steep learning curve with new schemas

- Joining input file data to schema fields

- Generating a well-formatted RML file

- Validation, testing, and development required before a new model appears in the risk report

Together, these create many opportunities to make mistakes and introduce errors that cause model risk.

test comment april 14